Implications of oil prices on the construction infrastructure in Saudi Arabia

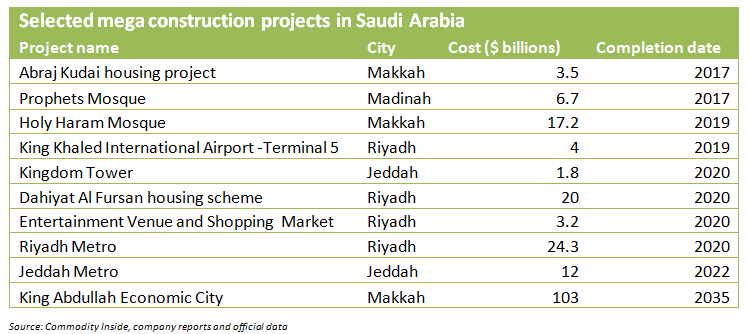

Growing population pressure and falling oil prices have been forcing Saudi Arabia to diversify its economy and attract investment in non-oil related industries. This will require some huge investment in the country infrastructure. The government has already prepared a long term development plan called Vision 2030 which encompasses all major sectors including building infrastructure. A number of multibillion projects have already been announced in recent years to support the construction industry.

The oil revenue-dependent kingdom has currently been facing financial challenges because of subdued oil prices in the international market. Saudi Arabia is an oil-based economy with reserves of almost one-quarter of the global oil share. It is the second largest oil producer and the biggest exporter in the world. We assess that petroleum products, on average, accounts for around 90% of the government fiscal revenues, about 85% of export earnings and contribute around 40% to GDP.

Lower oil prices have posed a significant challenge to the construction sector recently. Major construction related companies are adjusting their business strategies accordingly. As a consequence of low oil price, Saudi Arabia for the first time reduced spending to $220 billion from its original budget of $233 billion in 2016 with the budget deficit of $79 billion. A budget deficit of $98 billion was also recorded in 2015 due to fall in oil prices. The deficit is estimated to be reduced around $52.8 billion in 2017 on the back of expected higher oil prices and increase in non-oil revenues. It is also likely to have further cuts if oil prices remain lower than the government targets of $60 per barrel.

The fall in revenues in 2015 and 2016 forced the government to cut its expenditure which had a huge impact on infrastructure and construction activities. The budget allocated to the infrastructure and transportation sector was $ 16.8 billion in 2015 which was reduced to just 6.3 billion in 2016. However, in line with rising oil prices, allocations for infrastructure and transport again increased to $ 13.8 billion in 2017.

Going forward, there will still be uncertainty in the private construction market due to weak oil prices. However, the government will likely to continue its ongoing mega projects with a small cut in the infrastructure spending. Moreover, the government has lifted the ban on exports of cement and steel to reduce the shock of low oil price. Therefore, cement, steel and other construction related industries will see some stability.

Commodity Inside Principal Analyst Dr. Iqtidar Ali Shah writes “We anticipate that current weak oil prices would have some implications on the Saudi construction industry in the short run. Oil price will remain volatile this year due to a number of reasons which will lead to further production cuts. New oil supply from Iran and improved supply from Libya and other OPEC members will keep prices under pressure over the coming years. We forecast that oil prices will reach around $70 a barrel by 2022.”

In the backdrop of suppressed oil prices, it is expected that construction activities will remain slow over the next five years. However, the Saudi government is committed toward completion of ongoing large-scale projects and keen to maintain its spending plans by using foreign reserves to support the construction and infrastructure sector.