Organic Coated Steel Market Outlook

£1,995

Organic coated steel market outlook report provides valuable historical and forecast statistics of the global organic coated steel industry covering coated steel prices, demand, supply, revenue, trade statistics, capacity by plant and prices. It also provides detailed demand by key end use sectors. The report also provides a concise analysis of key trends and developments in the coated steel industry.

Description

Organic Coated Steel Market Outlook

Industry Insight

Commodity Inside continues its expert range of steel analytics with its brand new product, the Global Organic Coated Steel Market Analytics. The report examines the organic coated steel industry, which is also known as prepainted steel or prepainted galvanised iron (PPGI).

The report provides all organic coated steel market data in Excel dashboard where the users can easily slice and dice or plug-in the data into their in-house models. The organic coated steel data goes back to 2010 and also provides forecasts out to 2023. It encompasses demand, supply, trade, prices and end-use sectors statistics. The report also provides a succinct overview of the key factors influencing the organic coated steel market. It also includes a detailed methodology and explanation of the assumptions behind the forecasts.

Coverage includes historical and forecasts of the following

- Production of organic coated steel

- Demand for organic coated steel

- Revenue of organic coated steel

- Imports and exports of organic coated steel in volume and value

- Capacity of organic coated steel by plant

- Capacity utilisation of organic coated steel by country

- Prices of organic coated steel

- Organic coated steel demand by end users

- Macroeconomic indicators

Organic Coated Steel by End User

- Appliances

- Building and Construction

- Others

Organic Steel Prices:

- China, prepainted steel coil, Export, FOB, $/t

- China, prepainted steel coil, (ex-works), RMB/t

- The Far East, prepainted steel coil, Import, CFR, $/t

- Europe, prepainted steel coil, Import, CFR, €/t

- Europe, prepainted steel coil, Ex-works, €/t

- Unites States, hot-dip galvanised steel, Domestic, $/st

- Unites States, prepainted steel coil, Import, CFR, $/st

Why should you buy this product?

- Full coverage of the global organic coated steel market (prepainted steel) in both volume and value terms

- Detailed market projections of 51 national markets

- Dynamics behind emerging trends in demand and supply

- Exclusive data on end-use sectors demand

- Understand undersupplied and oversupplied markets

- Trade wars and its implications for the domestic demand, supply and prices

- Identify key growth areas

- Keep track of capacity changes

- Current and future price developments

- Interactive Excel dashboard

- Forecasts are based on both qualitative and quantitative forecast models

Who can benefit from this report?

- Steel producers

- Prepainted steel buyers

- prepainted steel producers

- Steel end users

- Distributors, service centre and stockists

- Suppliers of raw materials

- Suppliers of plants equipment and machinery

- Financial institutions

- Government bodies

- Associations

Methodology

Global Organic Coated Steel Market Analytics contains valuable resource necessary for examining the organic coated steel industry. This market analysis report is prepared based on a very robust methodology by incorporating both qualitative and mathematical approaches. We have used both top-to-bottom and bottom-to-top methods to assess the coated steel industry and its dynamics. We have more explanation about estimating the market size and market forecast on our methodology page.

Why our analyses are robust and authoritative?

We have decades of experience in analysing the steel industry. We have the full coverage of downstream industries such as automotive, construction, energy and packaging as well as maintain the full suite of steel products.

Table of Contents

Section 1- Introduction and Methodology

1.1- Introduction

1.2- Definitions, assumptions and methodology

Section 2- Market Analysis

2.1- Key emerging trends and developments in coated steel (prepainted steel)

Section 3- Regional Analysis

3.1- Production

3.2- Demand

3.3- Trade

3.4- Capacity

3.5- Prices

3.6- End users

Section 4- Organic Coated Steel Market Analysis by Country

4.1- North East Asia Organic Coated Steel Market

4.1.1-China

4.1.2-Japan

4.1.3-South Korea

4.2- South and South East Asia Organic Coated Steel Market

4.2.1- India

4.2.2- Indonesia

4.2.3- Malaysia

4.2.4- Thailand

4.2.5- Vietnam

4.3- Central and South America Organic Coated Steel Market

4.3.1- Argentina

4.3.2- Brazil

4.3.3- Chile

4.3.4- Colombia

4.3.5- Peru

4.3.6- Venezuela

4.4- North America Organic Coated Steel Market

4.4.1- Canada

4.4.2- Mexico

4.4.3- United States

4.5- Europe Organic Coated Steel Market

4.5.1- Austria

4.5.2- Belgium

4.5.3- Bulgaria

4.5.4- Czech Republic

4.5.5- Finland

4.5.6- France

4.5.7- Germany

4.5.8- Greece

4.5.9- Hungary

4.5.10- Italy

4.5.11- Macedonia

4.5.12- Netherlands

4.5.13- Norway

4.5.14- Poland

4.5.15- Portugal

4.5.16- Romania

4.5.17- Serbia

4.5.18- Slovakia

4.5.19- Spain

4.5.20- Sweden

4.5.21- Turkey

4.5.22- United Kingdom

4.6- The CIS Organic Coated Steel Market

4.6.1- Kazakhstan

4.6.2- Russia

4.6.3- Ukraine

4.7- Middle East, Africa and Oceania Organic Coated Steel Market

4.7.1- Algeria

4.7.2- Egypt

4.7.3- Iran

4.7.4- Libya

4.7.5- Morocco

4.7.6- Saudi Arabia

4.7.7- South Africa

4.7.8- Australia

4.7.9- New Zealand

Section 5- Global Organic Coated Steel Capacity by Plant 2017 (’000 tonnes)

Section 6- Global Organic Coated Steel Exports and Imports by Country 2010- 2017 (’000 tonnes)

Section 7- Global Organic Coated Steel Exports and Imports by Country 2010- 2017 ($ millions)

List of Tables

List of Tables in Chapter 3

Table 3.1: Market assessment of global organic coated steel production, by region, 2010 – 2017 (million tonnes)

Table 3.2: Market forecasts of global organic coated steel production, by region, 2018 – 2022 (million tonnes)

Table 3.3: Market assessment of global organic coated steel demand, by region, 2010 – 2017 (million tonnes)

Table 3.4: Market forecasts of global organic coated steel demand, by region, 2018 – 2022 (million tonnes)

Table 3.5: Historical market size of global organic coated steel, by region, 2010 – 2017 ($ millions)

Table 3.6: Forecasts of global organic coated steel market size, by region, 2018 – 2022 ($ millions)

Table 3.7: Historical Net exports of global organic coated steel, by region, 2010 – 2017 (million tonnes)

Table 3.8: Net exports forecasts of global organic coated steel, by region, 2018 – 2022 (million tonnes)

Table 3.9: Exports of global organic coated steel, by region, 2010 – 2017 (million tonnes)

Table 3.10: Imports of global organic coated steel, by region, 2010 – 2017 (million tonnes)

Table 3.11: Organic coated steel capacity, by region 2017 (million tonnes)

Table 3.12: Historical organic coated steel prices, by major markets, 2010 – 2017 ($/t)

Table 3.13: Organic coated steel prices forecasts, by major markets, 2018 – 2022 ($/t)

Table 3.14: North East Asia organic coated steel demand by end users, 2014 – 2022 (million tonnes)

Table 3.15: South and South East Asia organic coated steel demand by end users, 2014 – 2022 (million tonnes)

Table 3.16: Central and South America organic coated steel demand by end users, 2014 – 2022 (million tonnes)

Table 3.17: North America organic coated steel demand by end users, 2014 – 2022 (million tonnes)

Table 3.18: Europe organic coated steel demand by end users, 2014 – 2022 (million tonnes)

Table 3.19: The CIS organic coated steel demand by end users, 2014 – 2022 (million tonnes)

Table 3.20: Africa, Middle East and Oceania organic coated steel demand by end users, 2014 – 2022 (million tonnes)

List of Tables in Chapter 4

Table 4.1: China organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.2: Japan organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.3: South Korea organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.4: India organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.5: Indonesia organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.6: Malaysia organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.7: Thailand organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.8: Vietnam organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.9: Argentina organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.10: Brazil organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.11: Chile organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.12: Colombia organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.13: Peru organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.14: Venezuela organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.15: Canada organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.16: Mexico organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.17: United States organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.18: Austria organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.19: Belgium organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.20: Bulgaria organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.21: Czech Republic organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.22: Finland organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.23: France organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.24: Germany organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.25: Greece organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.26: Hungary organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.27: Italy organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.28: Macedonia organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.29: Netherlands organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.30: Norway organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.31: Poland organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.32: Portugal organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.33: Romania organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.34: Serbia organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.35: Slovakia organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.36: Spain organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.37: Sweden organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.38: Turkey organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.39: United Kingdom organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.40: Kazakhstan organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.41: Russia organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.42: Ukraine organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.43: Algeria organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.44: Egypt organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.45: Iran organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.46: Libya organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.47: Morocco organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.48: Saudi Arabia organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.49: South Africa organic coated steel industry: key industry indicators, 2010 – 2022 (‘000 tonnes, $ millions, % change, % share)

Table 4.50: Australia organic coated steel industry: key industry indicators, 2010 – 2022, (‘000 tonnes, $ millions, % change, % share)

Table 4.51: New Zealand organic coated steel industry: key industry indicators, 2010 – 2022, (‘000 tonnes, $ millions, % change, % share)

List of Figures

Figure 1.1: Methodology for market assessment and forecast of organic coated steel

Figure 3.1: Global organic coated steel production by region, 2010 – 2022, (million tonnes)

Figure 3.2: Global organic coated steel demand by region, 2010 – 2022, (million tonnes)

Figure 3.3: Global organic coated steel market revenue by region, 2010 – 2022, ($ millions)

Figure 3.4: Net exports of global organic coated steel by region, 2010 – 2022 (million tonnes)

Figure 3.5: Global organic coated steel exports by region, 2010 – 2017, (million tonnes)

Figure 3.6: Global organic coated steel imports by region, 2010 – 2017, (million tonnes)

Figure 3.7: Organic coated steel prices by major markets, 2010 – 2022, ($/t)

Figure 3.8: Global organic coated steel demand by end users, 2014, (million tonnes)

Figure 3.9: Global organic coated steel demand by end users, 2022, (million tonnes)

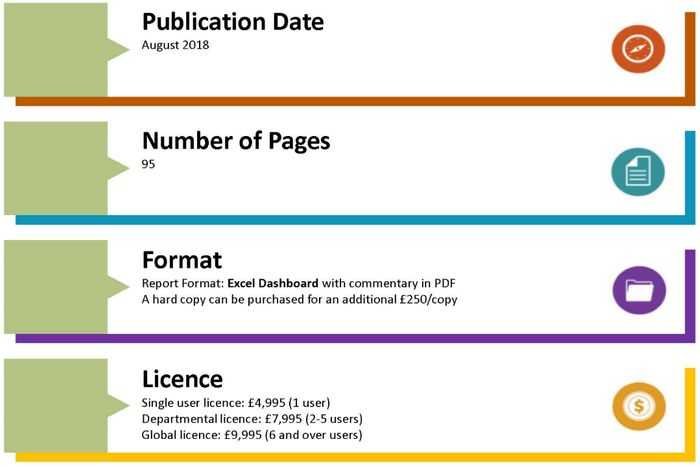

Licence Types